Understanding 2025 Real Estate Market Dynamics

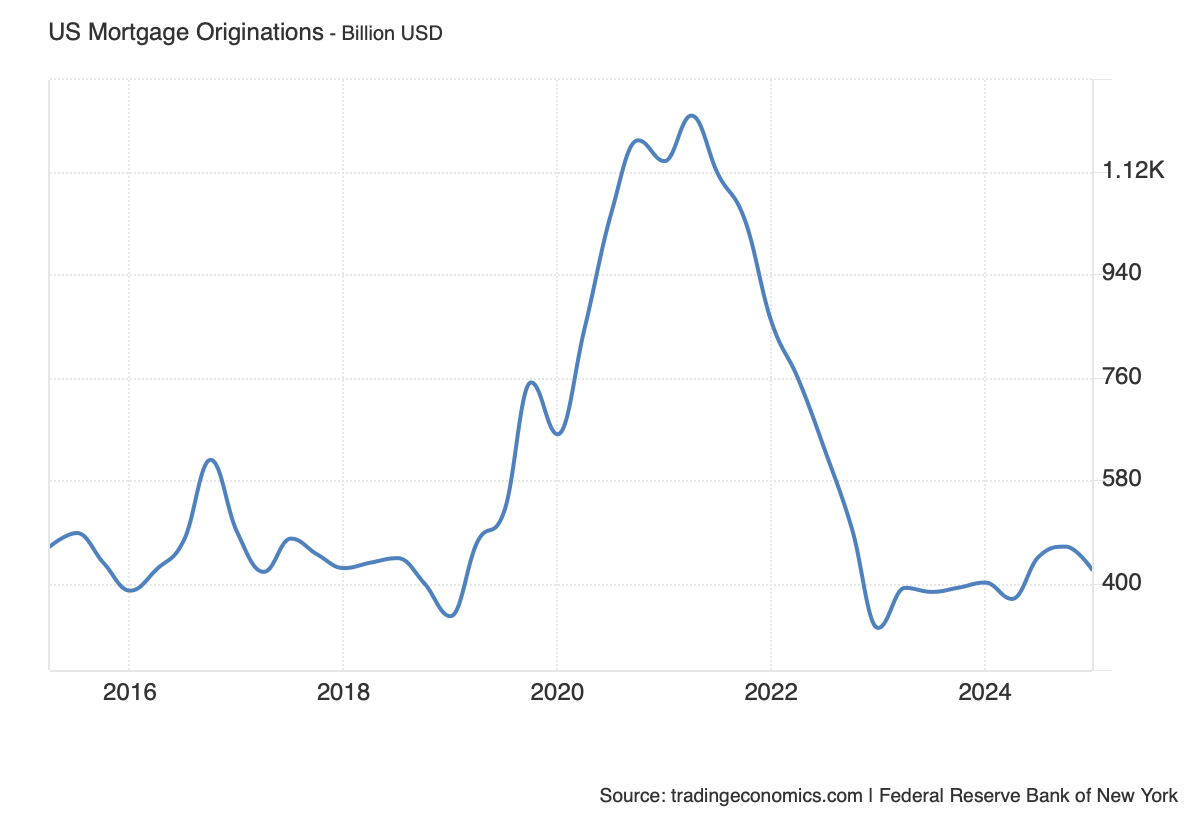

The above chart is the number of U.S. Mortgage Originations in the United States in the last 10 years. What this chart shows us is that the higher interest rates have caused the demand for mortgages to initially drop to their pre-pandemic levels.

Why This Matters

According to the National Association of Realtors, 74% of all home sales last year were financed and 26% of them were cash sales. 91% of first time home buyers need a mortgage in 2024.

Supply + Demand = Price

Demand's Downward Pressure:

The price of any good is subject to the amount of supply and demand. Here we see that potentially 74% of the housing demand (the mortgage portion) has significantly decreased due to much higher mortgage rates.

Talk to your agent about the number of days on market in the particular neighborhood you are looking to buy or sell in.

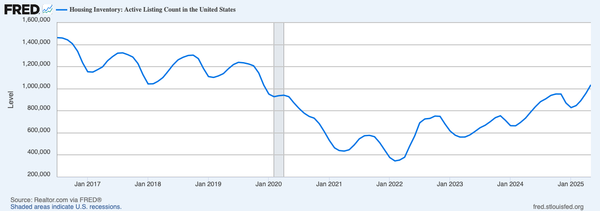

Housing Supply

Supply will undoubtedly be restricted by those that purchased with a low interest rates not wanting to pay a higher interest rate for a new home. However, there are a few things that may significantly impact the job market on the horizon.

- The federal government is downsizing.

- The rapid rise of Artificial Intelligence that could potentially eliminate many traditional entry level jobs or potentially advanced ones like programming.

- The U.S. debt crisis could cause borrowing costs to continue to rise which could further restrict the economy.

Make sure that your agent gives you a report that shows you the amount of housing inventory (supply) in the market that you are looking to buy or sell in!

Price

This is where this matters. There may be downward pressure on price in your neighborhood especially if:

- You notice a large number of homes for sale in the neighborhood.

- You see sellers advertising concessions and or price decreases.

In a rapidly changing market, pay close attention to recently closed pricing data.