This is my first home purchase. What do I do?

Buying your first home can seem overwhelming, but my goal is simplicity and baby steps! Here are the first two steps of my process.

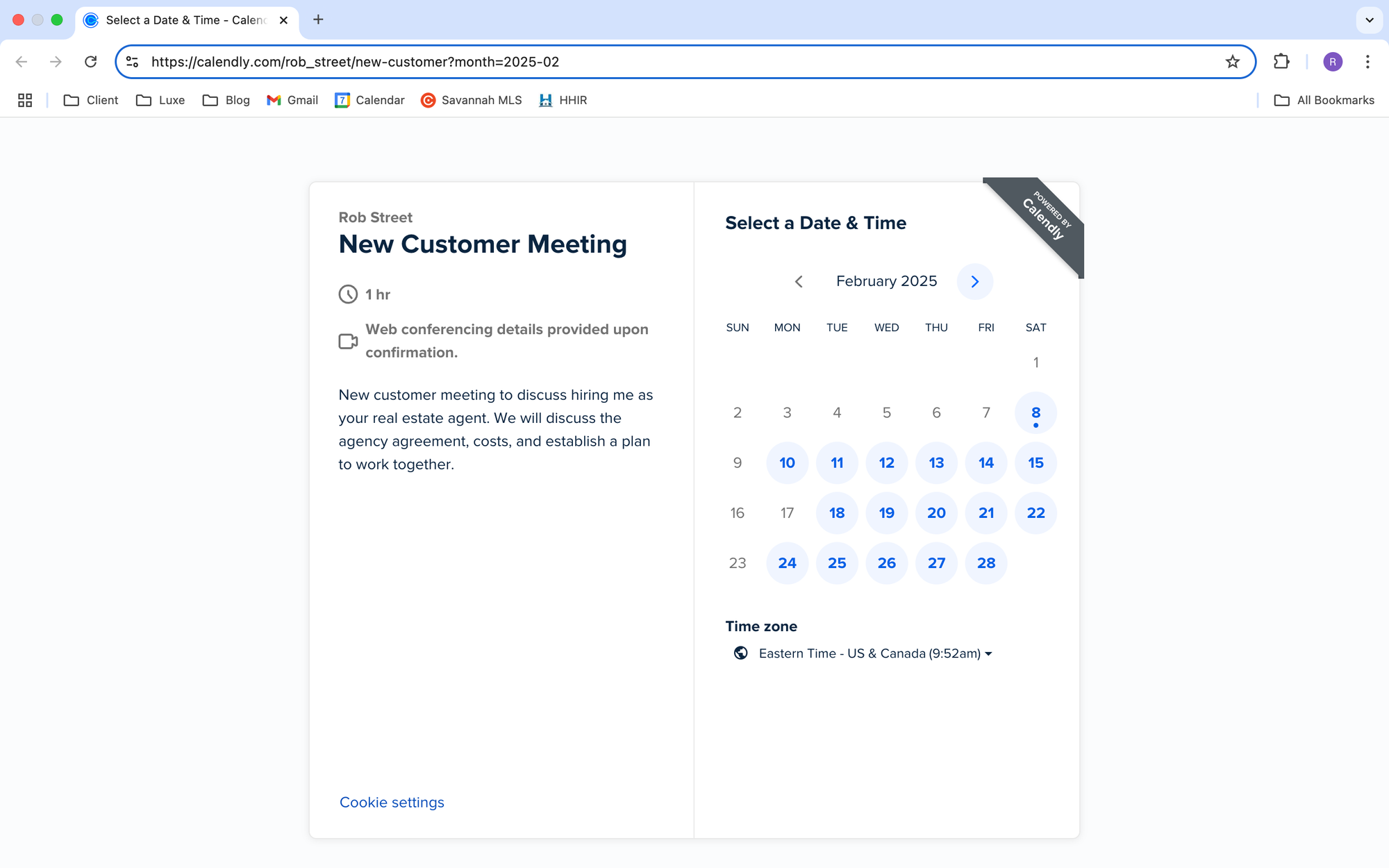

Step 1: Schedule an appointment with me!

I try to make this very easy for my clients. My first appointment operates online and you can pick your own time from my online calendar system. This way we don't have 5 conversations about what time works for all of us! The first appointment is always free and there is not a commitment at that time. It lasts about an hour and I go over the whole process with you!

Step 2: Determine a Budget

- How much money do you want to put down?

- What do you want your monthly payment to be no higher than?

- Reach out to a lender of your choice for a quick phone conversation to figure out a home price you can likely afford. This is called a pre-qualification letter. This conversation should not pull your credit.

- If you want to be more prepared to buy, consider filling out a loan application. This application will require that you upload all of your information so that a loan officer can determine your eligibility for different loans. The goal of this process is to obtain a pre-approval letter. Having this on hand ahead of showings, can speed up the offer process and if we are operating in a competitive market, can be an advantage when submitting an offer over someone that just has a pre-qualification letter if the two offers were similar in nature.

- If you would like me to suggest some lenders, please let me know in our first meeting and I am happy to provide you with a list.

- Thank you!