Mortgage Rates as of April 2025

As of March 27, 2025, the average 30-year fixed mortgage rate in the United States stands at 6.65%, reflecting a slight decrease from the previous week’s 6.67%.[1]

Recent Trends in 30-Year Mortgage Rates

Throughout 2025, mortgage rates have exhibited modest fluctuations. For instance, in February, the rates were slightly higher, averaging around 6.76% on February 27, before gradually declining to the current rate of 6.65% by late March.

How does this compare to last year?

As of March 27, 2025, the average 30-year fixed mortgage rate in the United States is 6.65%, reflecting a slight decrease from the previous week’s 6.67%. Compared to the same period last year, when the rate was approximately 6.87%, current rates have declined by about 0.22 percentage points. [1]

My Thoughts

Inflation is caused by too many market dollars chasing a fixed number of goods and services.

Inflation is a sign that an economy is over heating.

Price is determined by supply and demand.

Deflation occurs in an economy when there are not enough dollars chasing the number of goods and services in an economy.

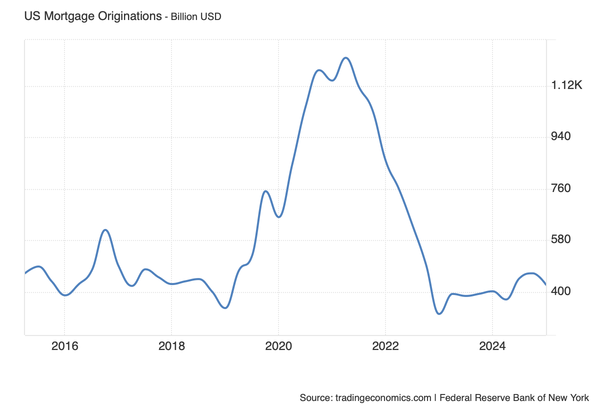

Because we have had a period of inflation driven by low interest rates and Covid dollars, I believe interest rates will remain elevated until we see signs of severe deflation in the housing market.

These signs include:

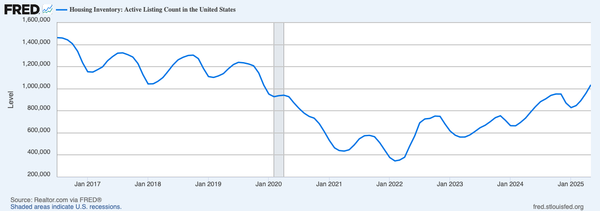

- A sudden spike in supply.

- A sudden drop in demand.

- A sudden drop in price.

If / when these things occur, the Fed will likely lower interest rates in order to help the economy to recover.

Given that we have inflation, the economy does not need this tool to recover as the market is currently overheating.

What NAR Says

Looking ahead, the National Association of Realtors (NAR) forecasts that the average 30-year fixed-rate mortgage will stabilize around 6.0% in 2025. This anticipated stabilization is expected to boost new housing construction and stimulate demand for existing homes. The NAR projects 4.5 million existing home sales in 2025, with median home prices increasing by approximately 2% to an estimated $410,700. [2] [3]

It is important to remember that absolutely no one can predict the future. If you are in the market to buy or sell a house in Savannah, Ga or Hilton Head Island, SC I would love to help!

- Federal Reserve Bank of St. Louis. 30-Year Fixed Rate Mortgage Average in the United States (MORTGAGE30US). FRED, 2025, https://fred.stlouisfed.org/

- “Realtors Group Forecasts U.S. 30-Year Fixed Rate Mortgage Averaging 6% in 2025.” Reuters, 12 Dec. 2024, https://www.reuters.com/markets/us/realtors-group-forecasts-us-30-year-fixed-rate-mortgage-averaging-6-2025-2024-12-12/.

- National Association of Realtors. Pending Home Sales Index. NAR, 2025, https://www.nar.realtor/research-and-statistics/housing-statistics/pending-home-sales.